3 min read

Small Business Owners: How to Chart Your Course to a Spectacular Retirement

Heidi Clute : June 10, 2021

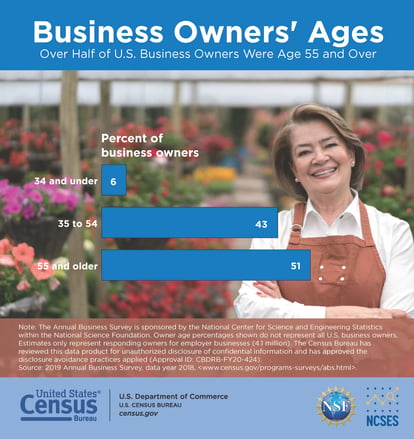

There’s a myth out there that most owners of small businesses and startups are younger people. In fact, the opposite is true: Most business owners are age 55 and over.

That reality can turn what are usually the peak earning and retirement savings years from your late 40s to late 50s into something more akin to watching " The Perils of Pauline." But it doesn’t have to be that way. Let’s look at how to avoid common perils and chart your course to the retirement you want while continuing to concentrate on the ongoing needs of your small business.

Now…

- Plan your journey carefully

- Study the charts

Starting Your Journey

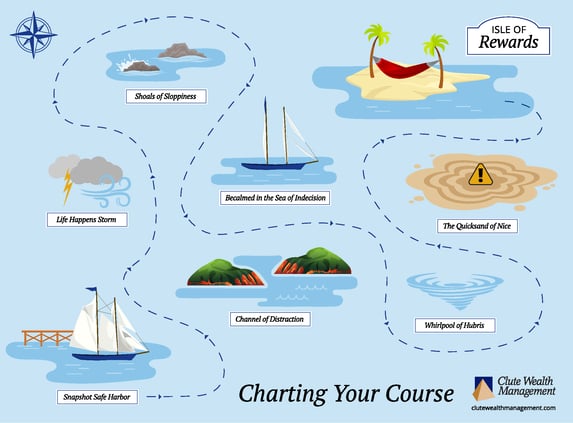

We embark, as do all financial journeys, from Snapshot Safe Harbor. As a financial planner and long-time business owner myself, I know that any worthwhile and successful voyage requires preparation. Depending on your form of business organization, you may need to take a financial snapshot of where you are now as an individual — see Financial Health Checkup — as well as a separate snapshot for your business. You cannot chart your course unless you know your starting point.

Pick your captain

You want someone experienced in small business and financial planning work -- preferably a CFP® or business coach — to help you chart your course.

Pick your potential crew

Does your team of professionals have all the necessary skills, including the “foreign” language skills of tax or estate planning and small business attorneys? You’re not becoming an expert in the law, but you must be able to understand and communicate with specialists.

Start small

Just as sailors take day trips and practice runs with their crew before they head around the world, you may want to start with a financial plan for yourself and then build up to a more complex long-term business transition plan for your business.

Be clear about your destination

Imagine your Isle of Rewards. What does it look like? What are you bringing with you? The answers will be different for everyone, but you want a clear picture of the unique way you define a spectacular retirement. And research shows that happiness is more than meeting your basic financial needs. Life satisfaction goes beyond having good health and social connections to include having a sense of purpose and meaning.

Channel of Distractions

Channel of Distractions

So, you prepared well and have a financial plan to chart your course. Celebrate — but not too hard, because to get out of Snapshot Safe Harbor, we must look ahead to navigate through the Channel of Distractions. (“Distractions happen” is a term I heard just yesterday from a small business owner frustrated by a new personal matter and the resulting delay in starting their proactive financial journey.)

Financial plan in hand, now you’re sailing along well, doing good things at home and at work. What other hazards might lie ahead?

Becalmed in the Sea of Indecision

Becoming becalmed by indecision and procrastination about important financial decisions is common for small business owners. You have a lot on your plate, but your journey cannot proceed unless you actively review and decide on your ultimate destination, timing, and stopovers.

Shoals of Sloppiness

Sloppiness undoes many journeys. The compounding effects of drifting off course, not updating your power of attorney for business or personal affairs, or your beneficiaries, can undo your progress toward your destination.

Life Happens Storm

Plans are thrown out of whack because “life happens.” Your own illness or the unanticipated need to move into your mother’s home to act as a caregiver, or your teenager’s escalating mental health needs are examples of life events that can totally absorb your mental and emotional attention, leaving nothing for your business journey.

Whirlpool of Hubris

After a few years of success on your voyage, it’s easy to succumb to hubris, thinking you’re totally in control of your business journey. You may see no need for a backup plan. Or you may think why fix your financial plan if it isn’t broken? Perhaps you begin trusting your gut for major financial moves and making impulsive decisions. Beware the powerful circular pull of believing there are no possible events beyond your control.

The Quicksand of Nice

Women business owners face the gender stereotype and social expectation to be ‘nice.” Intentional and proactive planning for your retirement may require changing business and financial advisors, dealing frankly with difficult family members, or telling your second-in-command that they are not your chosen business succession choice. Being “nice” can be easier in the short run but it’s rarely an effective way to reach your destination of a spectacular retirement.

I alert you to these common business owner “perils” that can wreck your financial plan with one goal in mind: Being aware of potential hazards helps you avoid them. With all these dangers, why set out on the journey? … Because reaching your unique Isle of Rewards and enjoying a spectacular retirement is a wonderful place to be!

Resources

Retirement Plans for Small Entities and Self-Employed - IRS

Happiness, income satiation, Nature Human Behaviour, Purdue University psychologists

5 Secrets to a Happy Retirement, AARP

-------------

Heidi Clute, CFP® is co-owner of Clute Wealth Management in South Burlington, VT and Plattsburgh, NY, an independent firm that provides strategic financial and investment planning for individuals and small businesses in the Champlain Valley region of New York and Vermont. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. This information is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.